Compounder Exercise #5: Why & When I Will Buy WilScot Mobile Mini Holdings

Serial Acquirer + Complexity + Flexibility + Scale = Growing Competitive Advantages

An ideal investment has to tick a certain number of boxes for me.

It must be easy to understand.

It must be a free cash flow generating business (as measured by cash from operations less capital expenditures).

It must have attractive growth opportunities. This can be subjective from industry to industry, but I will note that in the absence of growth opportunities, a low PE combined with an aligned management willing to spend on buybacks is attractive. Look at Autozone as a good example.

It must have an advantage that allows it to outearn its peers, measurable in pure gross profit and efficiency metrics.

It must have an attractive, rational industry structure, where participants do not rush to lower prices and compete irrationally.

It is ideally not a business that is overly affected by cyclical trends.

It should ideally be a business that will not change decades from now. (Otis, Kone, Schindler, ODFL, Pool Corporation).

The company must foreseeably earn more with a great degree of confidence over the next 10-20 years. (Secular trend tailwinds, semiconductors is one that has been building for awhile. Just look at the number of smart chips/electronics growth per household.)

Ideally, as the company expands, its advantage grows, allowing it to earn more profits over time. Any SaaS platform does this naturally. Less naturally, Autozone, O’Reilly Automotives, Google, Meta Platforms.

Ideally - the company is building towards a monopolistic position or at least, a position of overwhelming advantage. It’s monopolistic position should come at a net benefit to those it serves rather than become a net parasitic effect on the economy. Scale economies shared using the Amazon model or the Costco model is a good example, though Costco is not a monopoly.

Long term oriented and appropriately incentivised management teams. At risk pay should form a bulk of the NEO / CEO pay and the insiders must have skin in the game. Capital allocation should be reasonable. Stock based compensation should not be egregious. The utilisation of buybacks when the business is being underrated should be active and heavy. In essence, we want a management team that act like long term owners of the business.

The business must be designed to be benefitting from some secular trend.

Willscot Mobile Mini Holdings Corp ticks each of these boxes. Let’s take a look.

#1 - An Easy to Understand Business

Wilscot has an easy to undersand business.

At the risk of oversimplification - they rent out or sell “turnkey” temporary storage or workspace solutions.

The company’s motto is “Ready to Work”, and they are proud to use that as a differentiator, insisting that its a

Here’s a slide from their recent presentations.

When I say “temporary” - I mean exactly that. Temporary.

Wilscot’s solutions are used normally when there are renovations or large construction projects / events.

Their profits are thus simplistic to assess. Revenue is split according to the follow segments for FY23.

What they make from rental rates less the cost of business is their profits.

Earnings will thus be positively or negatively driven by:

Average amount of space available for rent

Average rental rates

Customers typically lease these spaces from Wilscot over a number of years, which provide stronge recurring and predictable cash flows.

I’ll go over the competitive advantages below under the relevant heading.

#2 - It must be a free cash flow generating business

With the exception of 2018 when WSC invested significantly into acquisitions and capex for future branch locations, free cash flow was largely positive and free cash flow margins have ticked upwards from 11.9% in 2020 (yes, even during covid!) up to 24.4% in 2023. These are stellar free cash flow margins for an industrial / physicals based business, and imo, these are mainly because of the recurring business. WSC needs only sell its customers once every 3 years on average whereas most businesses need to incur repeated costs of selling every day.

(2018: WSC acquired 3 companies in 2018 including ModSpace, its largest competitor for $1.2 billion. WSC prepared units to be shipped to client sites, more branch locations = greater range of available solutions = greater profitability. Branch locations grew from 100+ in 2017 to 250 in 2024. It’s re-assuring to see fcf margins tick up over time due to this).

Note that while capex has been scaling up, the profitability / growth in revenues has been trickling in via the investments in branch locations. This is

#3 - It must have attractive growth opportunities

Wilscot’s growth opportunities will mostly be split into 3 paths.

Organically, they raise rents along the way depending on the contract’s individual clauses.

Inorganically, they acquire businesses (along with the physical locations and branches), cut off redundant backoffices and support teams, then cross sell value added products such as computers, air conditioning, wiring, lighting, and other furnitures and fixtures as needed to make their solutions turnkey. Value Added Products (VAPS) are suspected to be high margin and customers are often willing to pay a premium in order to have a ready to work solution versus have to outfit fixtures themselves.

To get a clearer sense of the enormity of what it takes to make a portable office solution “turnkey”, I recommend a prospective investor to read through the case studies posted by WSC here. A causal read through and any amount of project planning experience will reveal that the branch locations that WilScot has, the complexity of the projects they take on (schools, PGA tours, covid testing sites, temporary data centers for Meta etc) are key in establishing a competitive advantage and driving high margin add on products.

In less words, complexity + flexibility + WSC’s cost being normally just 0.5% of overall project costs (per their disclosures) normally means WSC gets to make more profits over time vs others. I don’t see this point being hammered home enough actually for any other write up so I’m choosing to do so here. Pay close attention to profitability as bran locations scale.

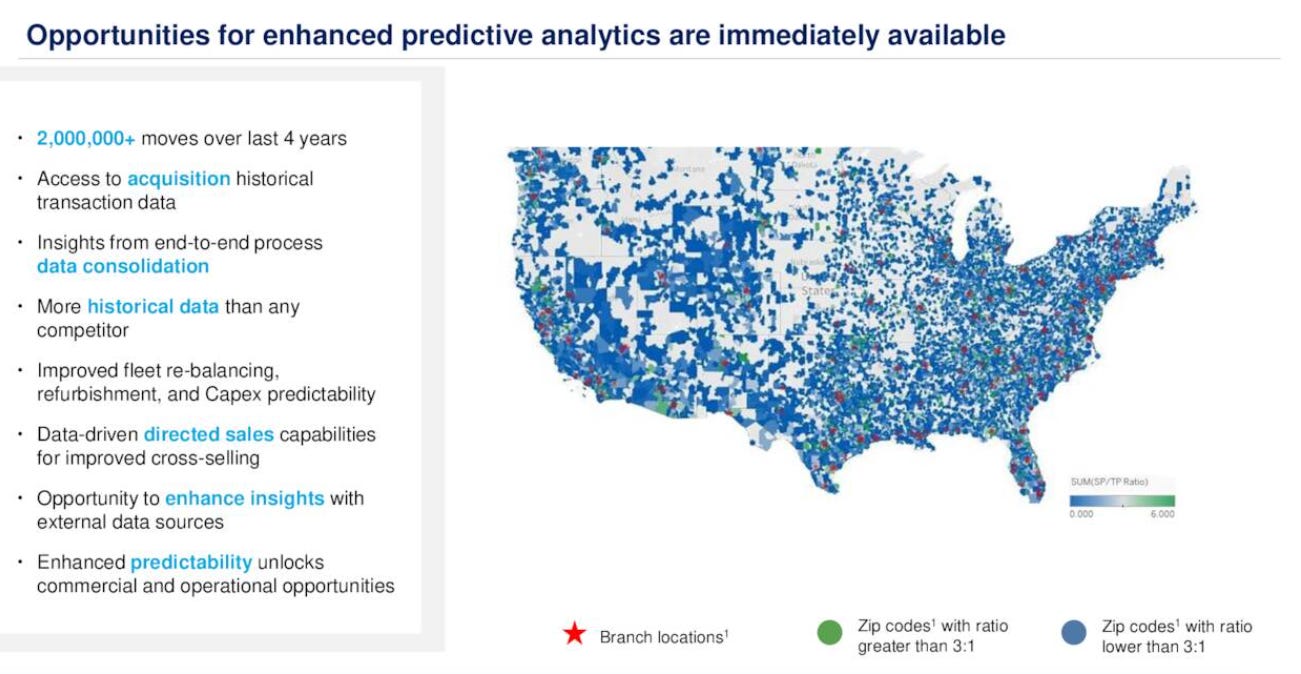

Technological innovations: WSC has repeatedly disclosed that they have been investing in their digital capabilites to drive profitability.

If this leaves you confused, then for starters, imagine yourself as Wilscot.

If your main job is to ensure (a) efficient distrubiton of assets so utilisation is as high as it can be with (b) rates as high as it can be, how would you arrange Wilscot’s 130 million square feet across America to efficiently extract value? If you’re coming up with a headscratch, then that’s where the predictive value of advanced analytics comes into play and probably what will be adding on 1-2 points of profitability over each year.

#4 - It must have an advantage that allows it to outearn its peers, measurable in pure gross profit and efficiency metrics.

I haven’t been able to establish whether or not its able to outearn its peers. First, it’s not acquiring Mcgrath, what was once its most comparable competitor. And while Mcgrath did beat out WSC in the past from 2015 - 2017, gross margins has largely lagged WSC turning into 2021.

2 year’s data isn’t much, but for now I’m willing to relax this particular criteria based on several factors.

its likely Mcgrath is the largest pure play storage / temporary office space provider. if the theory is correct (and has has been supported by WSC’s upward march in revenues and gross margins as well as fcf margins), then WSC should be able to outearn its competitors overtime simply due to sheer scale.

It’s hard for anyone looking for temporary solutions to explain choosing a smaller, less reputable player than WSC if WSC offers similar rates and similar turnkey solutions. That’s the baseline I’m working off of.

In any case, it would be fair of you to be critical and count this as not a ticked box. I leave it to the reader’s discretion.

#5 - It must have an attractive, rational industry structure, where participants do not rush to lower prices and compete irrationally.

Again, I cannot establish hard data on this without on the ground digging (which I’m not equipped to do from Asia). But let’s think on this a little.

Will a crazy, low price driven, volume emphasizing industry be able to provide high returns on capital and north of 45-55% gross margins for WSC and Mcgrath? Probably not. I would wager that in the absence of hard evidence, inferential evidence supports a rational, competitive industry.

#6 - It should ideally be a business that will not change decades from now. (Otis, Kone, Schindler, ODFL, Pool Corporation).

This one is rather simple to tick off. Unlike most tech stacks like coding languages or even banking technology, someone, somewhere always needs temporary storage/space turnkey solutions. Infrastructure will always be getting built, renovated, maintained, then torn down and rebuilt.

Throughout this cycle, Wilscot should be able to benefit from it.

#7 - Ideally, as the company expands, its advantage grows, allowing it to earn more profits over time.

It’s really easy to identify companies that make more money as they grow. If scale is the key to profitability, then taking a look at revenue growth vs gross margin growth vs free cash flow growth over time tells you almost everything you need to know.

Wilscot additionally publishes supplementary data here, which provides utilisation rates for both portable storage and modular spaces both. The two segments trend between low 60% to high 80% rates despite growing square feet from acquisitions.

Average modular space monthly rental rate has grown annually at 15.84%.

Average portable space monthly rental rate has grown annually at 16.3%.

Bottom line - I think there’s a lot of room to grow inorganically and organically and it will really depend on how WSC is able to execute. I’m fine w mid to low single digit rental growth rates over time if they can keep utilisation rates high while growing average rentable space.

#8 - Ideally. the company is building towards a monopolistic position or at least, a position of overwhelming advantage.

For better or for worse, I don’t think WSC will ever truly have a monopolistic position but I do think they will come from a position of great if not overwhelming advantage.

Firstly, temp spaces industry is 1st and foremost a price taking industry. Players compete on price, flexibility, complexity, speed of deployment.

Having an absolute advantage grants you incremental price increments but not absolute monopolist profits.

Having said that, I do think WSC will by far be the biggest benefactor from scale increments. Its gets steadily easier to do bolt on acquisitions, streamline costs by cutting out redundant marketing / backend teams and supply chains, add on branches and max out route densities. In other words, WSC should benefit the same way ODFL does.

#9 - Long term oriented and appropriately incentivised management teams.

To be clear - not perfect, but not a cluster fuck.

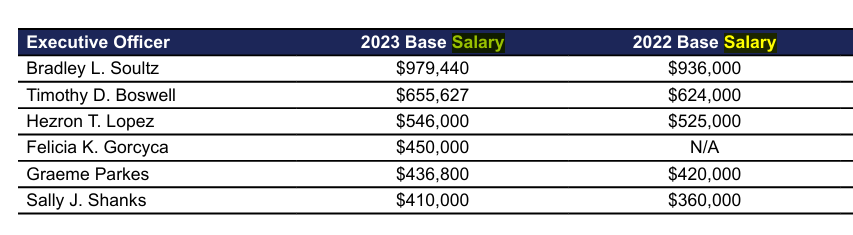

CEO has 88% at risk performance pay, it’s slightly less for exec officers.

Base salaries aren’t large. No one earns above a million dollars and gets to sit on the board wasting time. Everyone has a vested interest to get the shares vested.

Why I say they are not as aligned with shareholders as tightly as perhaps Autozone can be is because of the way they restricted stock units vest to the executive team.

Long term RSU grants come in 70-30 ratio, 70% performance based, 30% time based. Time based shares vest in instalments over 4 year periods at 25% a year.

For the 70%, they are incentivised to achieve specific measurable stock price performance over a 3 year performance period vs the SPY400 Mid Cap Index.

Specifically, no shares vest if the company's performance is below the 25th percentile of the index.

If performance reaches the 25th percentile, 50% of the target shares vest (threshold).

At the 50th percentile, 100% of the target shares vest (target)

And at the 85th percentile or above, 200% of the target shares vest (maximum).

For reference this is the respective performance over the past 10Y.

This essentially means WSC executives get paid 100% even if they do perform in line with the S&P400. They get paid twice as much if they’re in the top 15%!

Personally, I would have wanted to tie RSUs to return on capital and free cash flow per share metrics rather than total shareholder performance.

Why?

This is from the most recent proxy:

As of September 8, 2021, the amended agreement also contemplated an additional retention and performance incentive award consisting of a target number of 312,632 Performance-Based RSUs. The actual number of units that will vest and become unrestricted will be determined in accordance with the performance results as set in the agreement and may range from 0 to 750,000 units. The units will become vested and unrestricted on the vesting date, March 1, 2026.

This performance-based grant had no intrinsic value at grant and would not become eligible to vest unless the Company’s share price reaches at least $42.50 during the performance period.

The performance-based grant begins to qualify for vesting at $42.50 per share, with maximum earning potential if the share price exceeds $60.00 per share during the contract extension period.

Note however, that recent prices are now sub $40.

Do we claw back shares now based on that? This is why I prefer long term free cash flow per share and long term return on capital metrics being tied to performance.

This doesn’t give me warm fuzzy feelings - but its passable. I’ll just have to be sour at the dinner table for a little.

#10- The business must be designed to be benefitting from some secular trend.

In 2021, Congress in the USA passed a $1 trillion infrastructure bill. There seem to be few things both predominant parties in the US agree upon, but it seems like everyone agrees the infrastructure is garbage.

The macroeconomics of investing in infrastructure makes sense - Singapore is a huge example and I’m not about to say it doesn’t work.

This is however, excellent for WSC who specialises in providing temporary work solutions / storage solutions —> which are primarily driven by construction, renovation, maintenance and events.

Further, the US has a long way to go to be 5g ready. I suspect much more infrastructure investment ahead. This is an easy pass.

Now let’s estimate the returns investors get for investing in WSC today.

Forward Rate of Returns for Investors

Operations generated a total of $2.5bn cash overtime from 2017 to 2023.

Of that cash, through issuing debt, WSC retained $3.1bn, plowing all of the cash plus debt back into the business.

For $3.1bn retained, the business grew operating cash flow at an estimate of $762 million. Even if you waant to compare to 3-4 years ago, operating cash flow has doubled from 2020.

Incremental returns on cash seems to hover around 24%. Shares trade at 5.41% free cash flow to EV yield. I think at the high end, its possible to do 30% returns a year and at the base level we can expect 15% returns.

There are no dividend payments.

Let’s assume no buybacks

This still seems decent.

Oh and yes - I dont think this is a cyclical business. And yes - I do see the co earning forseeably more with their rate of acquisitions / rental increases / vaps cross selling / acquisition of Mcgrath, their biggest competitor / better scale.

Shares seem attractive considering $4 free cash flow targets by end 2024/25 and 10x free cash flow is too cheap for a business consolidating the temp space industry with such margins and returns on capital, even if mgmt isn’t as aligned as I’d like them to be.

Disclaimer

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article and one should take into account the investment objectives or financial situation of any particular person or institution.

Investors should obtain advice based on their own individual circumstances from their own tax, financial, legal, and other advisers about the risks and merits of any transaction before making an investment decision, and only make such decisions on the basis of the investor’s own objectives, experience, and resources.

The information contained in this article is based on generally-available information and, although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured, and such information may be incomplete or condensed.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested. This article and its author do not purport to identify all the risks or material considerations that may be associated with entering into any transaction. This author accepts no liability for any loss (whether direct, indirect, or consequential) that may arise from any use of the information contained in or derived from this writing.