Compounder Exercise #4: Can Motorola be a 100 Bagger?

Is 25% cagr possible to maintain over 20-30 years?

When we look for 100 baggers, the math is relatively straight forward.

To get a 100 bagger within 10 years, the business must compound at 59% a year.

To get a 100 bagger within 20 years, the business must compound at 26% a year.

To get a 100 bagger within 30 years, the business must compound at 17% a year.

The bar is then at least visible to the prospective investor. We need to search for businesses capable of compounding shareholder value at great rates.

Let’s look at Motorola Solutions ($MSI).

Last week, I was pretty astounded to realise the performance overtime of Motorola Solutions MSI 0.00%↑ .

While it’s nothing crazy, long term steady growth is what im looking for in terms of an investment.

There’s a host of other factors I normally deliberate, but nowadays, I always end up asking myself - “Is this the kind of business I want my wife/children to inherit if I pass away unexpectedly?”

That simple question tends to slam the door shut on lots of potential opportunities.

Motorola’s business overview caught me by surprise however since I’ve always assumed they were in the mobile phone business.

Let’s dig in to see if this is worth investing in.

Motorola Solutions ($MSI) Overview

While most consumers will remember Motorola for their phones, MSI 0.00%↑ was spun off as the more B2B part of the original Motorola Mobility entity, dealing mostly in video & telecommunications equipment, software, systems and services provider.

Motorola Solutions operates through the 3 primary business segments:

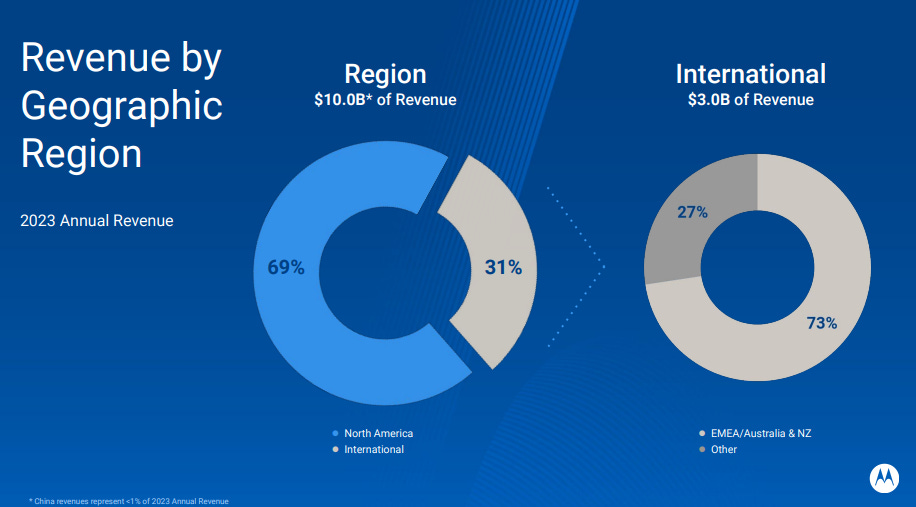

Geographically, the revenue breakdown is as follows:

By segment, as of 2023, as far as I can tell, they all seem to be growing quite steadily.

Of note, Motorola makes a distinction between primarily recurring and non-recurring services:

Note that the segments are split on the right.

On the left, it appears they group it under Non-Recurring vs Recurring.

Against a combined revenue of $9.978 billion for 2023, nearly half ($3.74B) is now recurring. Motorola aims to make that 40% by 2025.

That’s pretty decent.

Let’s figure out what investors can get today if we buy Motorola. Remember, this is meant to be an estimate - not precise.

MSI’s Compounding Rate

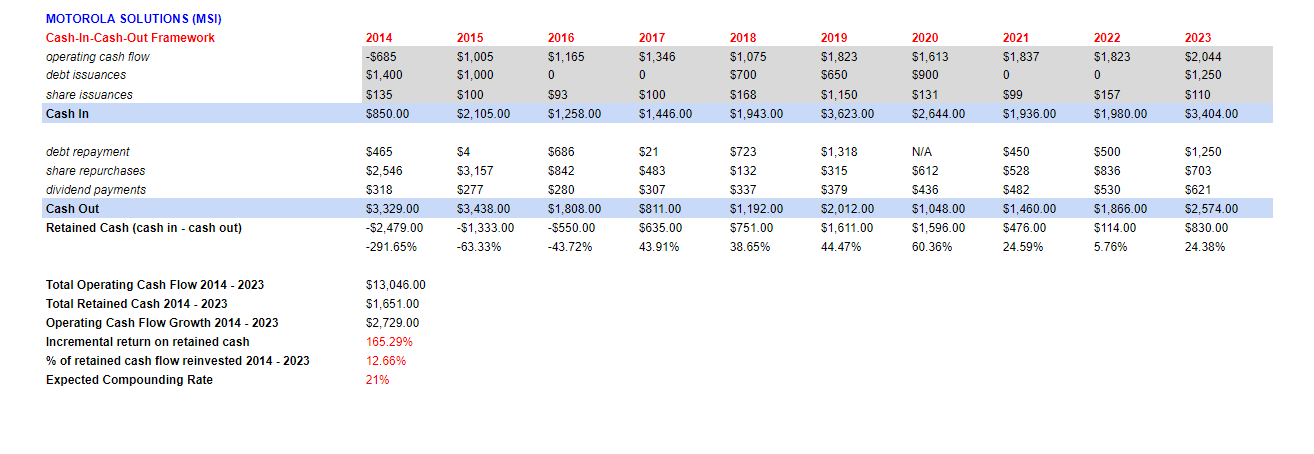

From 2014 - 2023, total retained cash was $1.6bn. Total operating cash flow was $13bn.

Retaining only 12.6% of all cash generated over this time period, Motorola solutions grew cash flow by $3.3bn using just $1.6bn of retained cash, giving us a stunning 200.42% of return on incremental cash invested.

With 12.6% retained cash and 200.4% incremental returns on cash, we’re looking at a 25% compounding rate. Over the past 5 years, buybacks have averaged 1.03%. Dividend yields have averaged 1.33%. If you total the returns, you’re getting approximately 27.36% (with some variance of course.)

Does this match up?

Well, for the past 5 years, return cagr has hovered around 20.96%! That’s not too far and seems to be within range.

Incentives & Managment:

I wanted to dive deeper into management with this post and try to figure out if incentives are truly as aligned as they can be.

I had a sense looking at the annual performance of the company that it would be closely tied to total shareholder performance (meaning management gets paid well if shareholders get paid well) and I think for the most part I’m right.

At risk pay for the CEO is 94% tied to incentives.

At risk pay for Named Exec Officers stand at 85%.

Nobody gets a free lunch while sitting on the shareholder’s dime.

As of 2024, not a single NEO earned above a million and Brown, who joined in 2003 and was appointed CEO in 2008, still earns barely above a million dollars in salary a year.

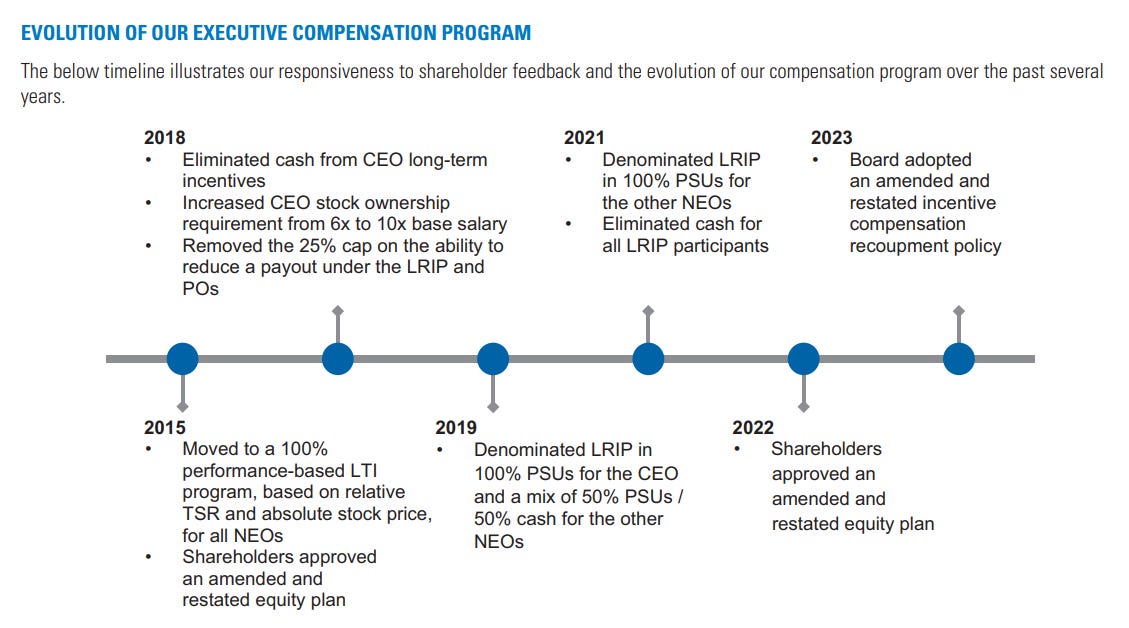

Funnily enough, we are also able to track back the changes of the incentives thanks to their proxy statement, where the management team moved to 100% performance based LTI

Notice anything strange?

I did. Here’s a hint.

Yeah. While I can’t say that the performance since 2015 has been due to the incentives being aligned, I realise I can’t exclude it either. And if the late great Charlie Munger has taught me anything - it’s that incentives matter.

The buybacks that have been done for the company also speak volumes.

Total shares outstanding have dropped a stunning 49% since 20 years ago.

Blue line denotes the repurchase of shares in dollar value.

Purple overlaid graph is the overall price/sales. Share repurchases have largely been opportunistic with the largest chunk of shares repurchased when overall shares were trading below long term price-sales ratios or whenever I guess management felt it was valuable enough to repurchase them.

This simple look through has told me volumes about the quality of Motorola Solution’s business, and I’m more or less certain I’ll establish a position in it sooner rather than later.

Disclaimer

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article and one should take into account the investment objectives or financial situation of any particular person or institution.

Investors should obtain advice based on their own individual circumstances from their own tax, financial, legal, and other advisers about the risks and merits of any transaction before making an investment decision, and only make such decisions on the basis of the investor’s own objectives, experience, and resources.

The information contained in this article is based on generally-available information and, although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured, and such information may be incomplete or condensed.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested. This article and its author do not purport to identify all the risks or material considerations that may be associated with entering into any transaction. This author accepts no liability for any loss (whether direct, indirect, or consequential) that may arise from any use of the information contained in or derived from this writing.