Note:

I’ve struggled for awhile as to what to write for this substack. I wanted to do all sorts of things but found that the practicality of that was underwhelming. Timely stock writeups are labor and time intensive. Options trades are seasonal depending on volatility based on the way I use them.

So instead I have decided to do a series of case studies trying to figure out the rate of return for various equities I’ve had on my mind and in a watchlist.

Hopefully, this series will help a few readers solidify the data in their heads or expose them to a new way of thinking / persepctive.

Whatever the case is - I hope to leave my reader better off after they have read my articles. And I will endeavor to make that stay true over the very long run.

I hope this is to your liking.

I could be wrong, but I think it was Peter Theil who said that monopolies often say they are not monopolies (Facebook, Amazon, Google, Apple) and non-monopolies often say are monopolies.

I don’t think it’s quite as clear cut as that but it’s a good enough sort of place to start.

Booking Holding’s Business Overview

If you’re a frequent traveller, you don’t need me to tell you about Booking Holdings anymore than Airbnb.

Per their annual report, Booking Holdings wants to “make it easier for everyone to experience the world. They do this through the five primary consumer-facing brands: Booking.com, Priceline, Agoda, KAYAK, and OpenTable.”

Revenues are broadly broken down into 2 categories:

Online travel reservation services (89%), which consists of:

Merchant revenues: $10.936 billion for FY23

Derived from using Booking’s online reservations

Agency revenues: $9.414 billion for FY23

Derived from travel reservation commissions from our reservation services.

Advertising / Other revenues (11%): $1.015 billion revenues

Key drivers for earnings therefore clearly fall under Merchant/Agency revenues, which by itself is a reflection of the health of global tourism.

Scale

It’s hard to imagine an online hotel reservation service being worth $125 billion, but a glance through Booking’s extremely integrated network reveals why.

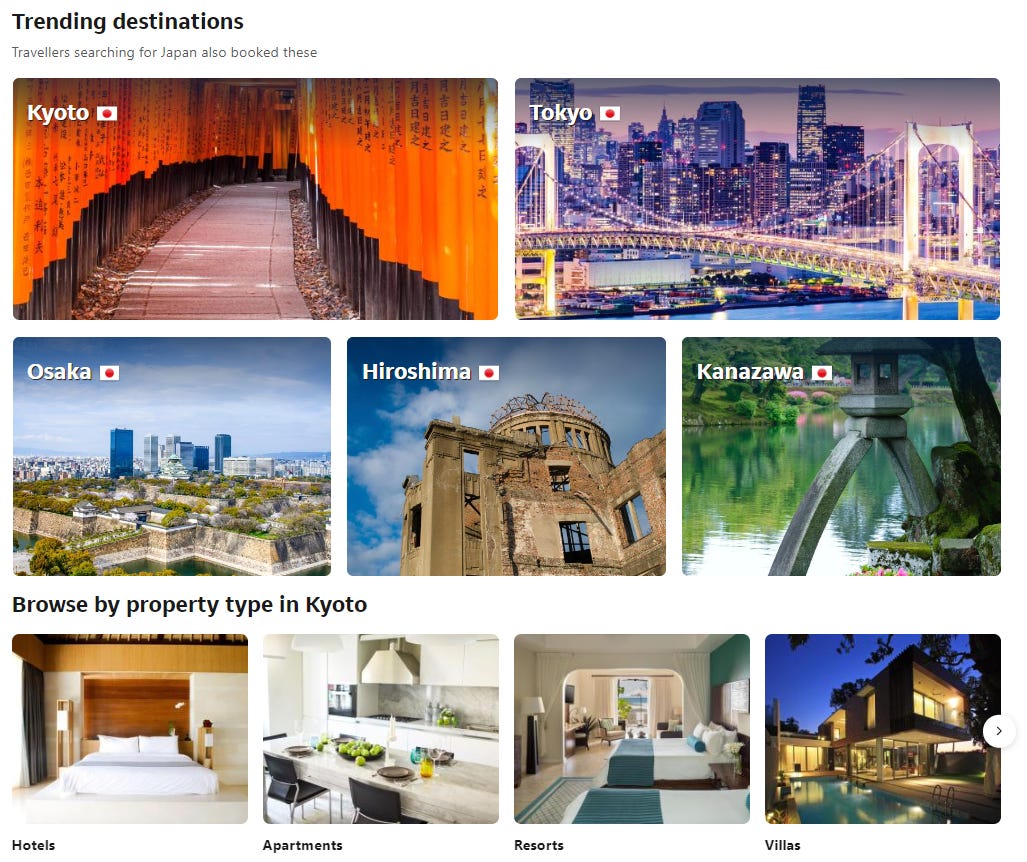

As of 31Dec23, Booking.com offered accommodation reservation services for approximately 3.4 million properties in over 220 countries and territories and in over 40 languages, consisting of over 475,000 hotels, motels, and resorts and over 2.9 million homes, apartments, and other unique places to stay.

Booking.com offered flights in 55 markets and in-destination tours and activities in 1,300 cities around the world. Booking.com offers online rental car reservation services in approximately 42,000 locations throughout the world and ground transportation services at over 1,900 airports throughout the world, with customer support in over 40 languages

The sheer scale of such an operation is hard to grasp until you take a gander through their website and figure out that whereever you want to go, there’s a 90% chance that Booking has something there to accomodate you.

That’s scale. And when you combine that scale with the fact that nearly everyone who wants a piece of the online travel business would list ON Booking.com, you have a profitable business.

Booking’s profitability reflects that economic reality, boasting;

84% gross margins

20% net income margins

26% return on total capital

There is no doubt in my mind that Booking is a profitable business.

But the key question remains - how much do investors pay?

Valuation

Operating cash flow per share $199.84 (FY23)

Free cash flow per share $195.97 (FY23)

At a current share price of $3,708.35,

we are paying $18.55 for every $1 of operating cash flow provided by Booking Holdings

We’re paying $18.92 for evern $1 of free cash flow generated by Booking.com.

In either case, the return seems to be about 5.2-5.5% per year returns (100% / 18.55x and 18.92x. That seem rather poor but isn’t quite the full story.

Cash In/ Cash Out

Based on prevailing numbers, it seems we can expect an approximate 11% compounding rate of return from the business itself.

If we take the compounding rate of 11% and the free cash flow / operating cash flow yield per year, we’re looking at about 16% returns on average.

Note however, the last row, which averages the total amount of cash reinvested over time - standing at 22.91%. With a 33.38% expected incremental return on cash invested, the business is looking instead at only 8% compounding returns. With a 5% return per year on the shares at current valuation and 8% current compounding rates, the business would deliver approximately 12-13% cagr per year.

Unsurprisingly, over the past 10 years, we’ve seen shares of Booking just about do exactly that.

Criticisms

There’s a fair bit of ingrained assumptions in the calculations.

The reinvested percentage might change

Underlying business might change due to things like Covid

return on incremental cash might change

Etc. But remember, for the most part, we’re not here to debate the precision of the method since all investing is a proability based endeavor and we’re simply trying to buy low enough that the odds are in our favor.

Though for good measure, it’s good to note that operating cash flow in 2020 (covid) was a mere $85 million and that share prices cratered to $1,177 a share.

Yes, if you had the long view, you’d be up 215% on your investment since 2020 (in a mere 4 years) but it would require you handling a 45% drawdown and frankly there are a lot of companies that you could’ve made a killing buying in 2020 and simply going to bed at night.

Anyway, the important bit is this, at 12.56% returns, elevated return to normalcy, and a worsening economic climate with a business clearly levered to global travel, I cannot say for certain that I would purchase shares in the business.

Maybe I’m wrong - and tourism goes on to new heights with a “soft” landing and no world wars developing. Maybe I’m right and the global business climate improves and tensions ease.

But wrong or right, 12.56% is just unattractive as a rate of return. Perhaps when share prices fall greater to give me maybe 15-20% returns, I would consider it, but for now this is a pass.

Disclaimer

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article and one should take into account the investment objectives or financial situation of any particular person or institution.

Investors should obtain advice based on their own individual circumstances from their own tax, financial, legal, and other advisers about the risks and merits of any transaction before making an investment decision, and only make such decisions on the basis of the investor’s own objectives, experience, and resources.

The information contained in this article is based on generally-available information and, although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured, and such information may be incomplete or condensed.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested. This article and its author do not purport to identify all the risks or material considerations that may be associated with entering into any transaction. This author accepts no liability for any loss (whether direct, indirect, or consequential) that may arise from any use of the information contained in or derived from this writing.

If you like bookings, you should check out Despagar. Travel tech company on LATAM. Solid mgmt, been executing well and I believe has a strong market share in LATAM. did a risk reversal option trade back in Q1 on a bet on its Q1 earnings. Returned me 200%. Looking to open a position once I free up some capital.