As established in my previous post, I tend to ask myself a series of questions before I buy a business. Overtime, these questions have become a checklist for me to use when evaluating a business.

Today, we’re going to take a look at Old Dominion Frieght Line ODFL 0.00%↑ .

Why ODFL? Simple.

$1 invested in their IPO in 1991 has become $314.87. A 313x return.

$1 invested 20 years ago in their stock has become $64.72. A 63x return.

$1 invested 10 years ago in their stock has become $7.45. A 6.45x return.

By any definition, Old Dominion Freight Line, a simple truckload carrier company has outperformed overtime for investors.

How?

Why?

And can current investors at today’s prices make a profit by simply and holding onto it for the next 3 decades?

Let’s find out.

#1 - Is The Business Easy to Understand?

Relatively.

ODFL 0.00%↑ is best described as a complex deliverer of parcels utilising Less Than Truckload (LTL) delivery systems.

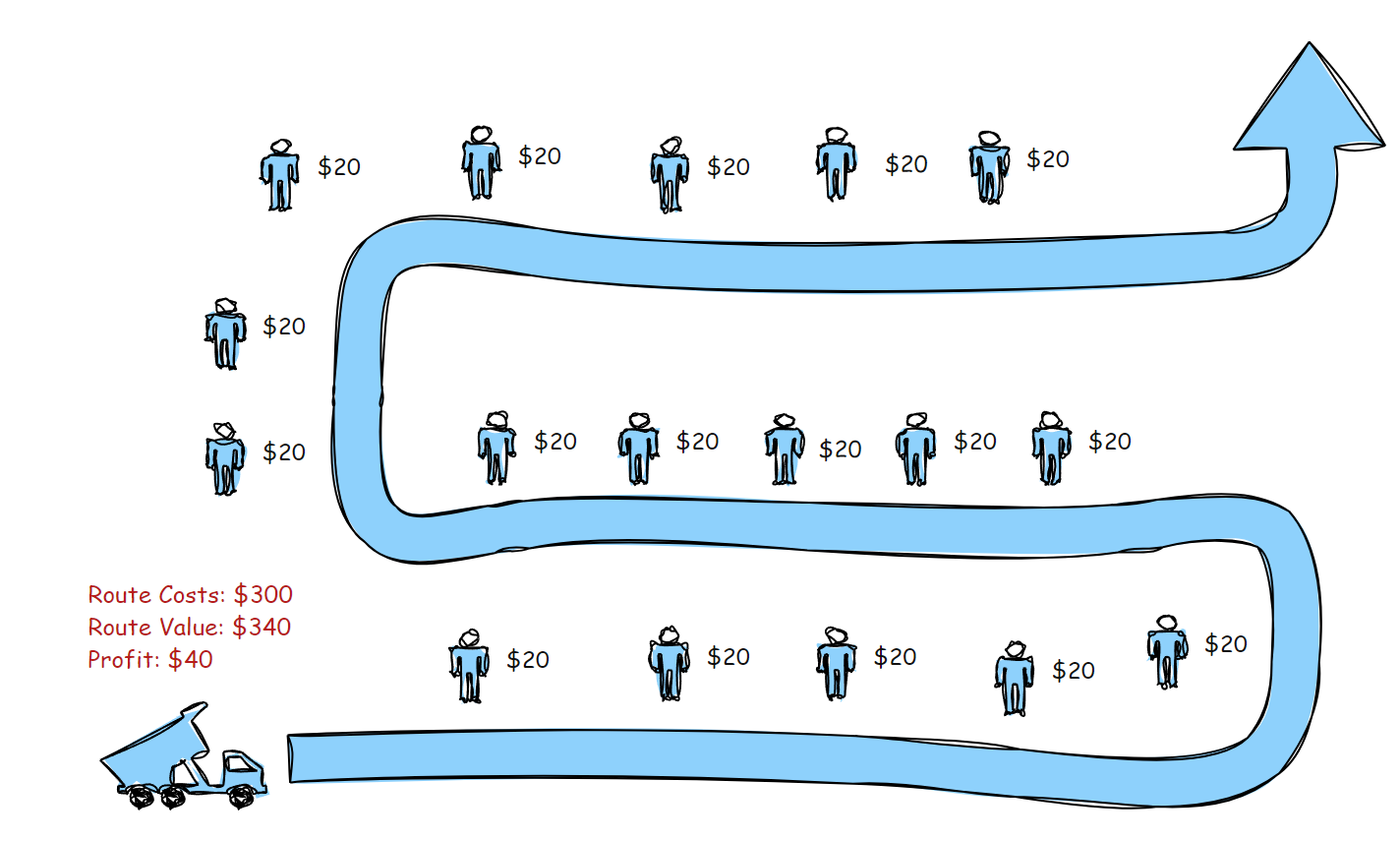

In this industry, the key to profitability is route density. Route density might sound complicated, but its actually simple enough.

Ta-dah! Route density, people.

It might be over-simplified but the working principle is the same. It costs the truck the same amount to travel that distance. The more people it serves, the better the margins get.

Imagine for a second, if there were not 17 people in the 2nd picture. but 30. That’s a $600 route value and every dollar over the cost of that route drops straight to additional margins barring some minor increments in time spent.

The below shows the complete process. The above truck diagrams represent parts (6) & (7).

For parts (1) through (5), you can guess at the logistical intensity necessary to develop the network / equipment / manpower needed to sort, pack, unpack, and ship goods across the country.

From that complexity and pain, comes the necessary effort, time and investment by ODFL 0.00%↑ to deliver a service.

Route density and complexity therefore provide enough of a buffer for Old Dominion to extract a profit.

Revenues have consistently grown and net income have consistently grown since 2009. There has been a drop in the recent years and it can be argued that the over-earnings in 2020-2021 is now coming back to stabilisation.

#2 - It must be a profitable free cash flow generating business.

The good thing is, if you understand that route density is the key to growth and the key to profitability, then you can understand this simple value chain:

Whatever increases Route Density > Increases Profitability

Does this hypothesis hold true?

I would argue yes.

ODFL publishes key metrics for the business for investors to follow and if you don’t like taking it at face value, you can run the operation ratio calculations yourself (operating expenses as a percentage of revenue).

If the route density hypothesis holds true —> then over time, as the route density scales, so should profits.

After all, if there were 200 stops in the this picture and not 17, then that same route would be wildly profitable over time (barring a larger operating time per route).

My point is, if the hypothesis holds true - the numbers should show up.

And it does. Operating Ratio ((operating expenses + cost of goods sold) / net sales) over time has dropped.

Either the cost of operations / goods has fallen, profitability has improved or a combination of both.

In this case, I think it’s both. Revenues per hundredweight and revenue per intercity mile have both gone up over time…and yet…

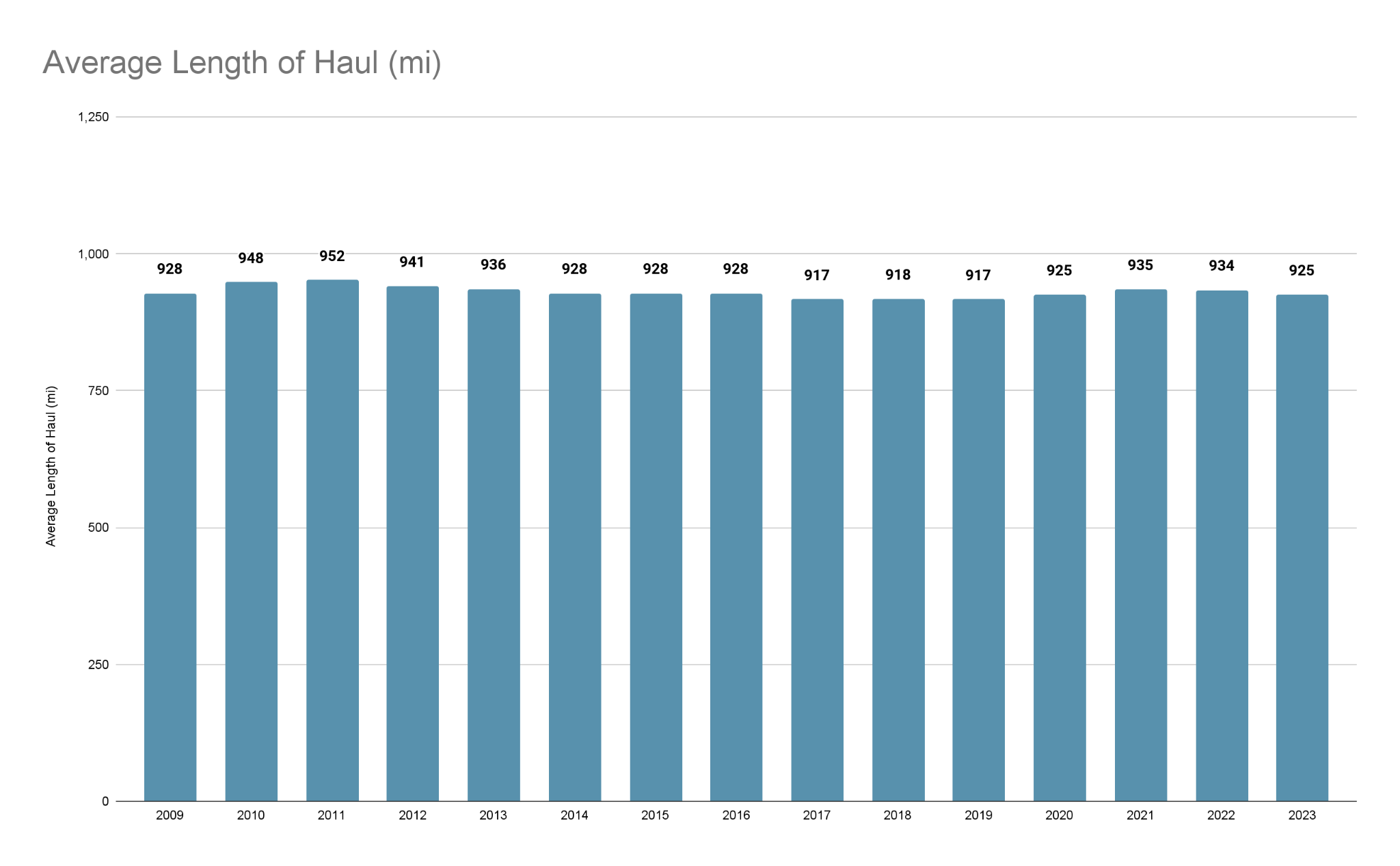

Average length of haul has NOT gone up meaningfully over time.

I would say this validates the route density thesis.

ODFL 0.00%↑ is a profitable business. My data only goes back to 2009, but as far as I can tell, there has never been a single year where ODFL has not been profitable.

For 2023, ODFL posted:

Return on Capital of 28.4%

Net Income Margin of 21.1%.

Free Cash Flow Margins of 15.4%.

These are stellar metrics for a physical business.

#3 -It must have attractive growth opportunities.

Does ODFL 0.00%↑ have stellar growth opportunities?

There’s no “conclusive” evidence to point this out but as always, inferential data reveals much.

In 2002, ODFL held just 2.9% of total market share [worth $19.4 billion]. Of 2022, it has 11.8% market share [worth $52.5 billion]. That means their revenues went from $562.6 million in 2002 to $6.1 billion in 2022. A 12.66% CAGR overall that has come with market share grab.

It’s hard to take market share normally.

It’s even harder to take it when the market is growing and the competitive environment is tough.

#4 -It must have an advantage that allows it to outearn its peers, measurable in pure gross profit and efficiency metrics.

ODFL's gross profit margin is notably higher compared to its competitors. For example, as of March 2024, ODFL's gross profit margin was 34.52%, consistently maintaining high levels over the past few years.

In contrast, competitors like Saia Inc (20.59%) and XPO Inc (10.70%) have significantly lower margins, indicating that ODFL is more efficient in converting revenue into gross profit by keeping costs low.

In every way, ODFL 0.00%↑ is more efficient. With or without conclusive evidence, ODFL 0.00%↑ is better off than its competitors. Off the record, ODFL drivers have said nothing but good things about their employer - a rarity in this industry. They also remain one of the only companies where their drivers are not unionised.

Per Mastio and company, out of 1,635 customers, providing approximately

5,300 total observations, ODFL 0.00%↑ was ranked 3rd as a LTL carrier. ODFL 0.00%↑ has been ranked #1 for 14 years at some point by the same company so colour me unsurprised that their margins and returns on capital are above industry average.

#5 -It must have an attractive, rational industry structure.

Old Dominion Freight Line (ODFL)

ODFL announced a 4.9% general rate increase effective March 1, 2024. This increase is part of their strategy to manage rising operational costs and maintain profitability amidst fluctuating market conditions (FreightWaves).

Saia

Saia implemented a 7.5% general rate increase, effective December 4, 2023. This increase was scheduled two months earlier than previous years, indicating a proactive approach to cost management and revenue stabilization (FreightWaves).

FedEx and UPS

Both FedEx and UPS announced significant rate increases. FedEx's rate increase averages 5.9% for various services, including FedEx Express and FedEx Ground, effective January 1, 2024. Similarly, UPS announced a 5.9% average increase for UPS Ground, Air, and International services starting December 26, 2023. These increases reflect efforts to cover rising costs and continue investing in capacity and capability enhancements (SigmaShip) (Sifted).

Seems like carriers aren’t increasing costs for no reasons. The exit of Yellow due to bankruptcy (as the 6th largest no less) highlights just how rampant competition is - and yet the largest fleets are raising prices, not lowering them.

Per above data, trends are pushing up, not down. Things look pretty rational here. Major competitors aren’t cutting prices for destructive long term volume grab.

#6 -It is ideally not a business that is overly affected by cyclical trends.

Fail. ODFL while not a fantastically cyclical business is clearly tied to economic outcomes overall. Good economy means more goods flowing means more deliveries.

Bad economy means less goods flowing meaning less deliveries and less revenues. Having said that, I’m certain ODFL 0.00%↑ will probably continue to take market share and unless we’re going through a great depression, the business’s cashflows should remain relatively resilient.

#7 -It should ideally be a business that will not change decades from now.

Pass. Physical goods need moving. Even when trucks start flying, we’ll still need them moved. You live in a physical world. This does not change.

#8 -The company must foreseeably earn more with a great degree of confidence over the next 10-20 years.

Pass. If I were forced to choose higher or lower over the next 30 years, my bet is higher.

#9 -Ideally, as the company expands, its advantage grows, allowing it to earn more profits over time. Ideally - the company is building towards a monopolistic position or at least, a position of overwhelming advantage.

ODFL 0.00%↑ fulfils this well.

As previously mentioned;

More route density —> more profitability.

But what’s driving route density is the ability to serve greater amounts of logistics and packages. Service centers, tractors, trailers have all grown year over year to serve that increased capacity.

#10 -Long term oriented and appropriately incentivised management teams.

Pass, the business is owner operated.

ODFL has what is called within the investment community “ownership-operators”. The CEO team is the family that started ODFL way back in 1934 with Earl and Lillian Congdon.

Today, it’s David Congdon. grandson of the original founders. The founders still have a significant stake and insiders overall own 12.3% of outstanding shares.

This is ideal - it incentivises long term focus and operational performance without endangering shareholders.

#11 -The business must be designed to be benefitting from some secular trend.

I don’t think I can state this definitively. But my guess is the miniturisation of technologies (phones, laptops, smart glasses, ipads, etc) and ecommerce in general has led to an increase over time in shipped goods. This trend looks to continue over time - regardless of the electrification of things. I think regardless, an economy constitutes moving parts and its hard to have much of an economy without one.

#12 - The forward rates of return must be attractive.

Cash In - Cash Out

Total operating cashflow generated from 2014 - 2023 was $9.3 billion. Total retained cash over the same period was $5.3 billion. With $5.3 billion retained, total operating cash flow growth was $1.1 billion. The expected compounding rate (reinvestment rate x return on reinvested capital) is expected to be about 13%.

Dividend yields is about 0.68%. Outstanding shares have went from 258.49 million shares in 2014 to 218.26 million shares in 2024. Share buybacks seem to reduce share count by about 1.88%. Putting it together, you’re looking at about 15% per share compounding value. ODFL is available at 2.59% free cash flow / ev yield. Assuming no crazy PE multiple drops, we can get maybe 18% returns a year.

If we want to do things based on average 3Y or 5Y valuations, ODFL is “slightly” undervalued. If we’re looking at 10 years, ODFL is overvalued.

But bear in mind - In 2013, ODFL earned $2.3b in revenues and $230+million in net income.

As of last year - ODFL earned $1.2 billion of net income against $5.8 billion of revenue. That’s a $1bn jump across a decade. I’m not sure relative valuations hold stock here but take what you will of it.

Morningstar rates ODFL’s fair value at $152, which means to them ODFL 0.00%↑ is kind of slightly overvalued now.

Repeatedly though, I’m drawn to the fact that compounding value of current shares at slightly depressed valuations is doing 15%. If PE multiples recover within 2-5 years to just 33-35x (as befitting a business earning 28.4% return on capital), and if returns per year looks to trend about 13% - 15%, then we can easily get high teens returns over the next decade.

Some pretty decent fund managers have also had this to say;

Terry Smith gives an example of how ROCE affects CAGR. In his example, you pay 4x book value for company A that has a ROCE of 20%, hold it for 40 years and sell on 2x book value. You buy Company B at 2x book value with 10% ROCE, hold it for 40 years and sell for 4x book value. In the end, Company A’s CAGR is 18% and Company B’s 12%. That example explains beautifully how important returns on capital is imo.

Charlie Munger talks about returns on capital as well, he says "Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result."

The source is compiled but the Munger quote is word for word and Terry Smith’s math works out.

In short - its hard to go wrong buying a company with consistently high returns on capital.

The durability of the cashflows seems solid if not exactly the most recurring and stable. But I think for all that is said and done, very few companies are not affected by general economic cycles.

I am a net buyer of shares of ODFL 0.00%↑ at $168.53.

Disclaimer

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article and one should take into account the investment objectives or financial situation of any particular person or institution.

Investors should obtain advice based on their own individual circumstances from their own tax, financial, legal, and other advisers about the risks and merits of any transaction before making an investment decision, and only make such decisions on the basis of the investor’s own objectives, experience, and resources.

The information contained in this article is based on generally-available information and, although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured, and such information may be incomplete or condensed.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested. This article and its author do not purport to identify all the risks or material considerations that may be associated with entering into any transaction. This author accepts no liability for any loss (whether direct, indirect, or consequential) that may arise from any use of the information contained in or derived from this writing.