Back to Options Selling

Had some portfolio movements as I took my 2024 planned hols to JPN.

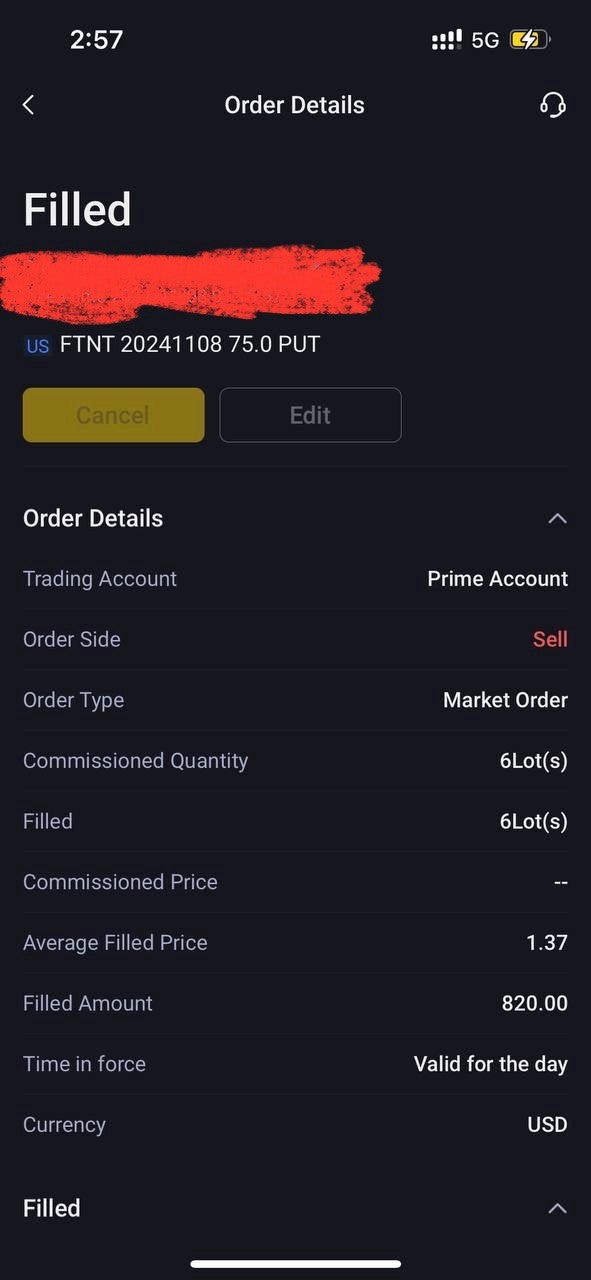

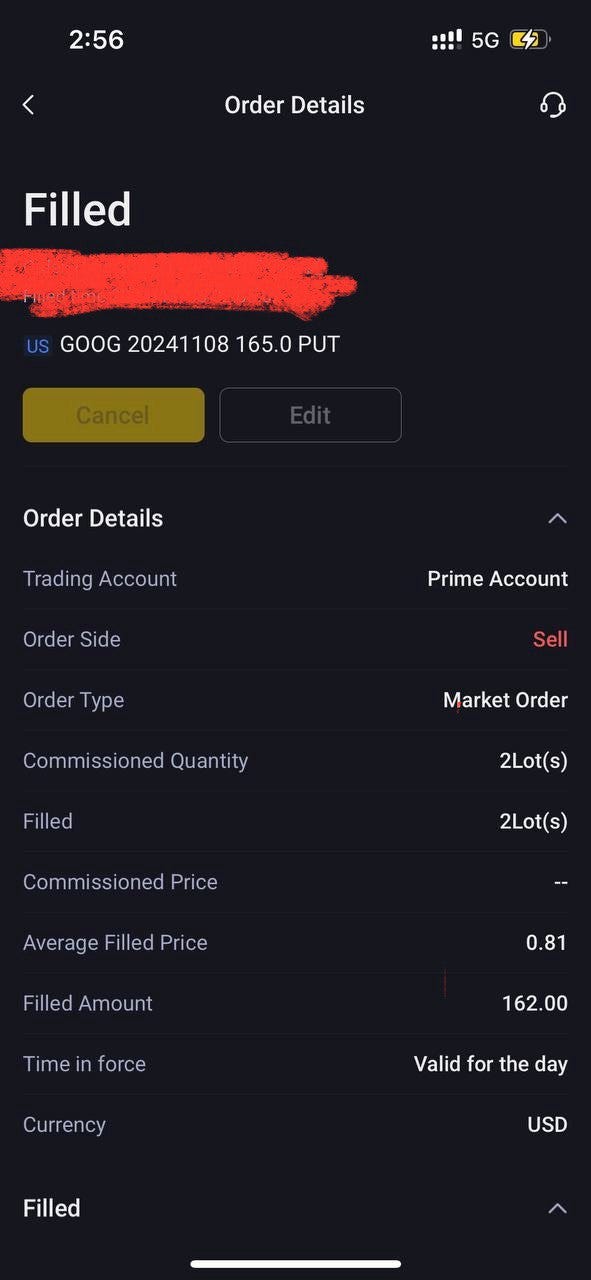

1st week of Nov, 08NOV(FRI)

- sold all BTI shares and long-dated calls for 45%+ gains or about 30%IRR on the portfolio.

- sold 2x GOOGL $165 cash secured puts for USD$162 premium. closed google options when the shares gapped up randomly on thursday night.

- sold 2x FTNT $85.0 covered calls for USD$610 premium.

- sold 6x FTNT $75.0 cash secured puts for USD$820 premium.

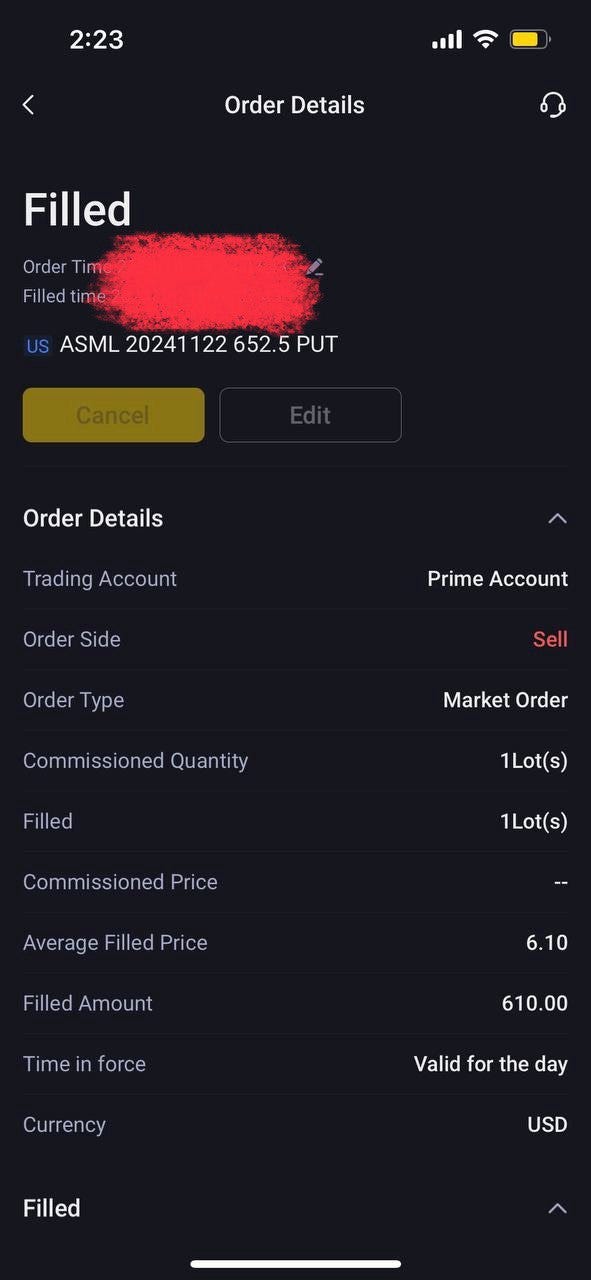

2nd week of Nov, 11NOV(MON)

- sold 1x ASML $650 cash secured puts for USD$670 premium

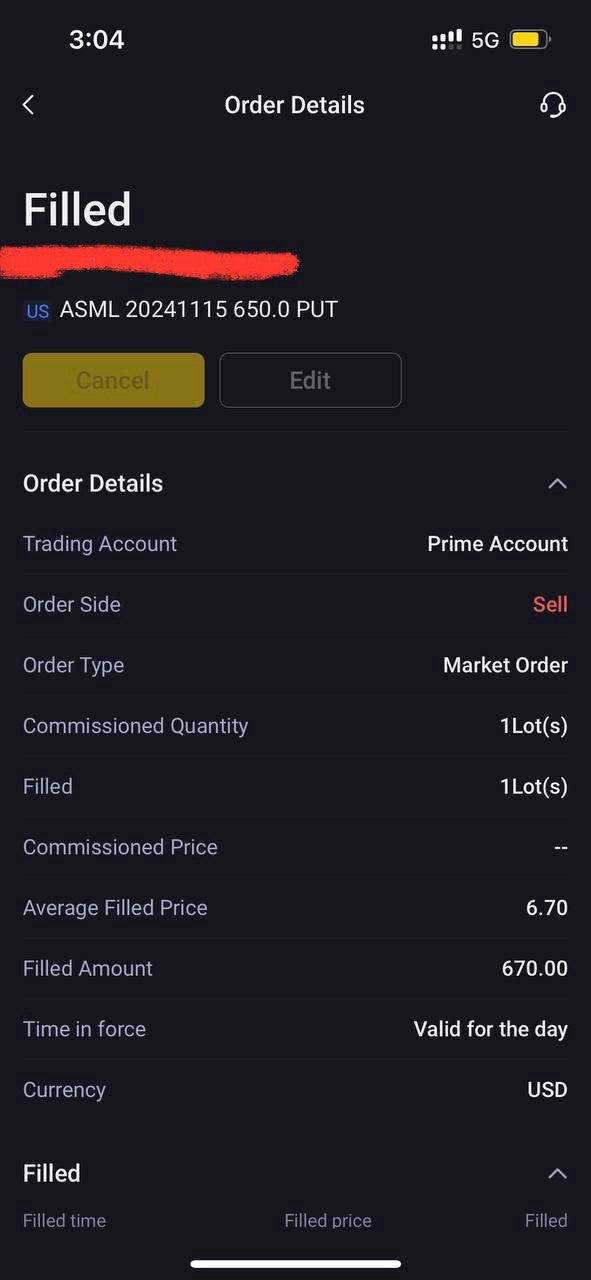

3rd week of Nov, 15NOV(MON)

- sold 1x ASML $652.5 cash secured puts for USD$610 premium

total premiums 3 weeks of Nov: USD$2,872 / SGD$3867.44.

Notes: (not investment advise, dyodd, caveat emptor)

1. I sold options for Google because shares are down (and are still down) significantly with the big antitrust suit in the US.

2. I sold calls/puts for FTNT because I owned shares and I didn't believe in too much of a movement post-calls, I was wrong. 200 of my FTNT shares were called though with my average at $67.35, I feel pretty decent about it. The puts expired worthless and I kept all the premium.

3. I sold puts for ASML (2nd, 3rd week of Nov) because ASML was under international (US mostly) pressure to restrict selling to China and shares were taking a hit. Shares peaked at EUR$1002 in Jul and is now at EUR$642.10. (note, the options I sold are for US listed shares, so EUR$642 = USD$668, hence the puts for $652.5 in 3rd week of Nov was not assigned and I kept the premiums)

4. ASML's PE ratio was 55.42x in Jul and 36.4x as of most recent trading. A 35% PE compression.

5. Google's PE ratio was 28.68x in Aug and 21.86x as of most recent trading. About 25% PE compression.

Screenshots attached. I've blurred out details for protection. I'm sharing this because I believe:

(A) selling your time only goes so far

(B) if you're born a Singaporean, with a stable government, not in a destitute position or an otherwise extremely unfortunate position, you should take full advantage to save/invest and earn

(C) most people don't realise (A) and (B).

Here's hoping it helps provide a little bit of hope in an otherwise rather gloomy world.

I'll prob re-sell options for ASML on Monday to cap off the month. 29thNOV puts look good still since the volatility inherent in a big share price slide pumps up the option pricing.