Type of Trade: Cash Secured Put

Ticker: ASML

I am shorting the ASML 0.00%↑ $740 strikes with $8.10 bids (yielding USD$810). If assigned, my new average for ASML shares will be $731.90.

I will seek a 0.5%-1% return on a weekly basis (aiming for 27% - 52% annual return amount on the options strategy) typically. If bids move materially for the Monday night open, I will use the target return range of 0.5% - 1% to select my strikes.

View:

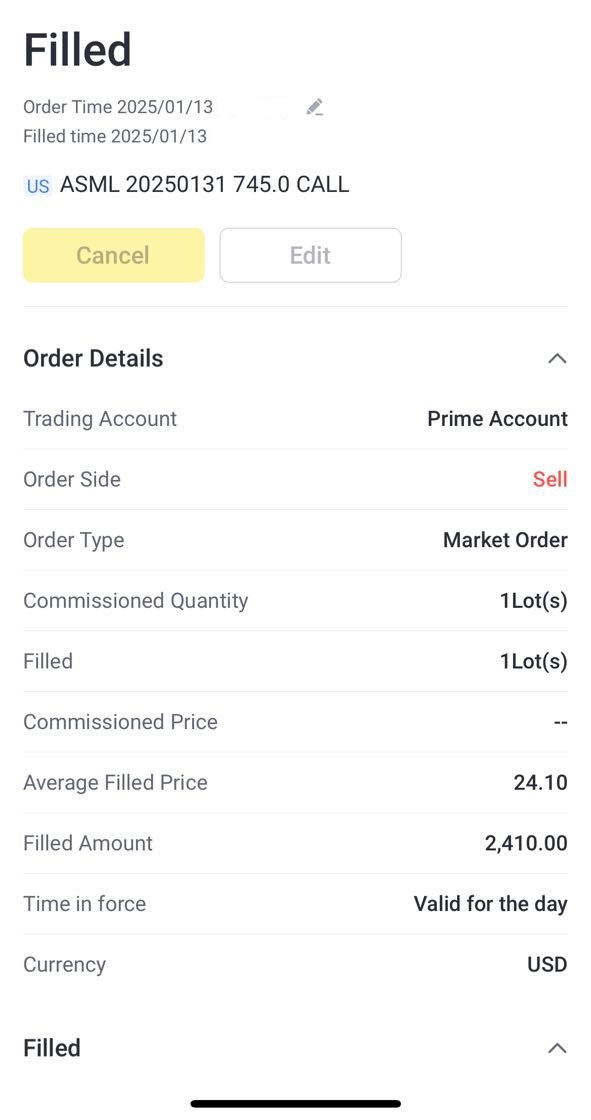

My previous short $745 strike covered call with $8.60 premiums yielding me $860USD has called previously assigned shares of $717.50 (refer to appendix for screenshots).

I believe ASML is still fundamentally undervalued and that selling cash secured puts represents a legitimate way to generate income while getting the opportunity to own the stock for cheap.

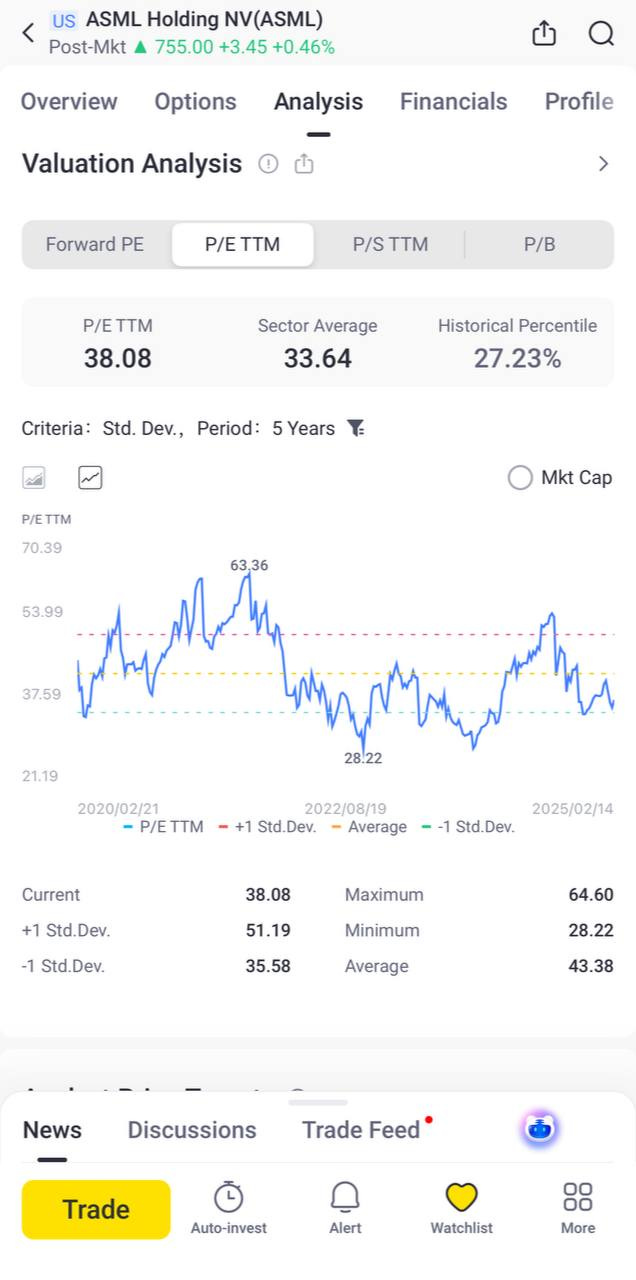

As a reference, ASML 0.00%↑ still trades meaninfully below long term TTM PE averages when compared over a 5Year period. I don’t believe that the only manufacturer of the EUV lithography machine in the world responsible for producing the world’s most advanced 5nm and below chips is worth sub 40x earnings when it grows free cash flow per share at CAGR 15% over the last 10 years.

At 29.52x ev/fcf, assuming a 10 year 10% cagr of free cash flow per share, you’re buying a 12x free cash flow business. At 12x free cash flow in 10 years, you’re assuming ASML in a short 10 years from now has a terminal value of zero - I assign that as a very low probability.

Approximately 95% of ASML lithography systems sold in the past 30 years are still active in the field. When companies buy $380 million machines, they don’t scrap them. They refurbish to hell and back to keep it running and get every production run they can out of it. Does that gel with the idea that in 10 years with a 10% growth in free cash flow average (they did approx 15% btw), the company is w

orth only 12x free cash flow?

Appendix

Discussion about this post

No posts