2024 Total Returns - 51% total, 57.29% XIRR

2024 total returns for the portfolio: 51%

2024 XIRR: 57.29%

Method of calculation:

[portfolio value as of 1st Jan 2025] - [portfolio value as of 1st Jan 2024] - [deposits for the year]

Kyith, at investment moats helped with the XIRR calculations for which I am indebted given my habit of not recording deposits.

XIRR assumptions place all deposits in June, which from a calculation perspective, should average out the time value it can push forward. I’m not being ultra precise with this, but at 51% total returns, I don’t think I need to be.

Clearly, 2024 has been a banner year of sorts and I don’t expect to perform like this every year. Against 2023’s 27% XIRR specifically, it felt a little scary.

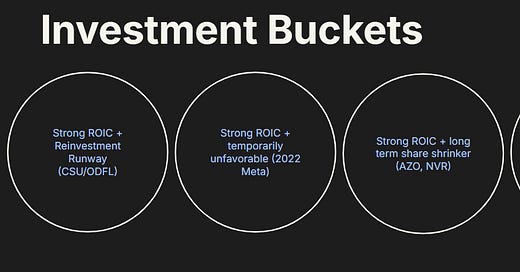

My process has shifted overtime more and more. Where I used to describe myself as a dumpster diver / compounder barbell sort of person, I’m now more of an '“aligned management team” / temporarily unpopular compounders / special situations sort of guy.

This has paid dividends (this year) obviously and I’m keen to look at what it offers for the next 5-10 years.

Current Positions & Average Purchase Prices:

Google

Average price: $162.36.

I mostly sold puts. I’ve stopped selling puts on this since the price has risen to a point where I no longer finder it attractive. Leap calls have also been sold.

Fortinet

Average $67.34. 200 shares were called via covered calls as of 09th Nov at $85. As detailed in my previous post, premiums were hefty at earnings at $610USD. I now hold just 8 shares which . I’ll prob add to this if I see the prices dip again and for now, it’s just a useful reminder everytime I look at the portfolio to check in on this periodically.

Advance Auto Parts

$59.71 average price. I sold calls but have thus far held shares. This is one of those names where things get worse before they get better, management has awhile yet to turn things around but based on recent transcripts and comments about operations, might be a 2-3 year turnaround. I’ll prob add to the position overtime or buy leaps when more cash becomes available.

First Citizens Bancashares

$1737.11 average price. No options traded. Buy and hold only position. I would add more overtime if the price hadn’t run up 25%. Call me a scrooge, but I particularly disliked how everytime an attractive security turned up, I just had almost no cash to deploy.

ASML NV

$717.50 average price. I’ve been steadily collecting premiums selling puts and only recently got assigned at $717.50. I’m taking $717.50 as the average since I don’t want to be intellectually dishonest and claim that the income from previous options lowers the average. If I want to retire selling options for income - this is realistically how it will operate.

Medical Facilities Corporation

$10.35 average price. Medical facilities is a company first covered by

. I won’t do him a disservice by saying more except that you should subscribe to him. Mr Huber, I’m indebted for your sharing.

1st Jan 2025 Portfolio Value: $197,960.

Recap of the Year

I started the year with a pretty big investment into BTI 0.00%↑.

The primary reason for investment was simple: an undervalued almost 4-5x free cash flow business paying 10% dividends is a no brainer investment provided that future cash flow streams were non-zero. And while it’s difficult to argue that BTI’s future cashflow streams are non-zero (17.9% of revenues, slice the true free cash flow contribution how you’d like), I couldn’t quite wrap my head around the 3 most important long term existential questions for BTI 0.00%↑ :

If smokeless is the new future given the turning industry winds, what is the % of market share that BTI can capture and how much free cash flow does that translate into?

With what degree of certainty are we estimating it to be? If we cannot estimate it, is the current confidence level of getting it right at least 50%?

If it is not - and share prices do not revert to 12x-13x earnings, at what point do you cut your investment and move on?

I could reasonably guesstimate the first and be wrong by a mile but the lessons from my previous shipping investments haunted me - a temporarily well doing business in a shitty environment doesn not translate to long term multiple re-ratings.

Shortly after, I decided to exit my investments in BTI and swung full tilt into Medical Facilities Corporation and started selling cash secured puts of ASML among other tickers.

The rest of the tickers in my portfolio are nothing new or amazing. I simply bought them when I felt the pe ratios were more or less -1 from the average, which is to say - they looked temporarily out of favor or undervalued. The profits that followed is more a function of return to the mean than any stock selection skills on my part. My “work” lies in having read up and doing the pre-work on the companies that suffered the temporary unfavorability in the markets ($META IN 2022 etc).

2025 Updated Approach

As mentioned earlier, I think my style / process / choices has evolved over time. My simple steps to figure out whether a company is investible or not is as follows:

In terms of valuation - beyond establishing what is the moat (or lack of one), I tend to rely on the cash in, cash out framework.

Then I try to figure out the returns on incremental capital over time

Finally if both criterias are clear, as long as the PE is at -1SD from average or even just average, I’m typically ok to move forward w the purchase. I might use options or not use options to play around with the equity risk but that’s about all there is to it.

On the special situations side, things are still developing so I can’t talk too much about the specific process. Interested readers can begin with the following actions:

Reading/Subscribing to Profiting from Corp Governance "Dark Arts": Part 1 by Mike from Nongaap Investing

You can start to look at some of Mike’s thematically veined corporate governance alpha sources by looking at UnlearningCFA’s Blog.

Finally, something I started doing a long time ago is to try and keep track for 30 mins a day on cluster insider buying from C-suite teams. You can do so here. Thanks to

for the resource on his website.Finally, if you can’t tell by now - no man is an island. I subscribe to various substack writers who I find either interesting or valuable. This is a non-exhaustive list.

*Note - I get no commissions nor a cut of any subscription revenues generated from this. These are my genuine recommendations. Have fun. Not eveyone on this list is affordable or even valuable to some of you - but that’s the way it is.

One final note - Selling Options to Enhance Returns

Not included or discussed here is how I’m using options (cash-secured puts or covered calls) to get the tickers I want at a lower price. It’s not much, but in 1.5 months alone, the options sold generated a solid income.

In premiums alone, contributions from selling covered calls/puts brought in $7,991USD. Against a $92k starting value (I’m discounting deposits for the year) - that’s an 8.6% yield in just 1.5 months. Call me nuts, but I don’t think I’m too far off my rocker to keep using options to lower my cost of acquisition.

Until next time, Irving.